Enculturate Your “Dirty Money” Clients

- Scott Peterson

- Sep 23, 2024

- 4 min read

Be careful. Dirty Money clients pose a significant risk to your business. While they may meet or exceed your financial expectations, their long-term impact can be devastating. These clients become increasingly dangerous when they represent a large percentage of your revenue, occupy key resources, and leave you feeling like you “can’t afford to lose them.”

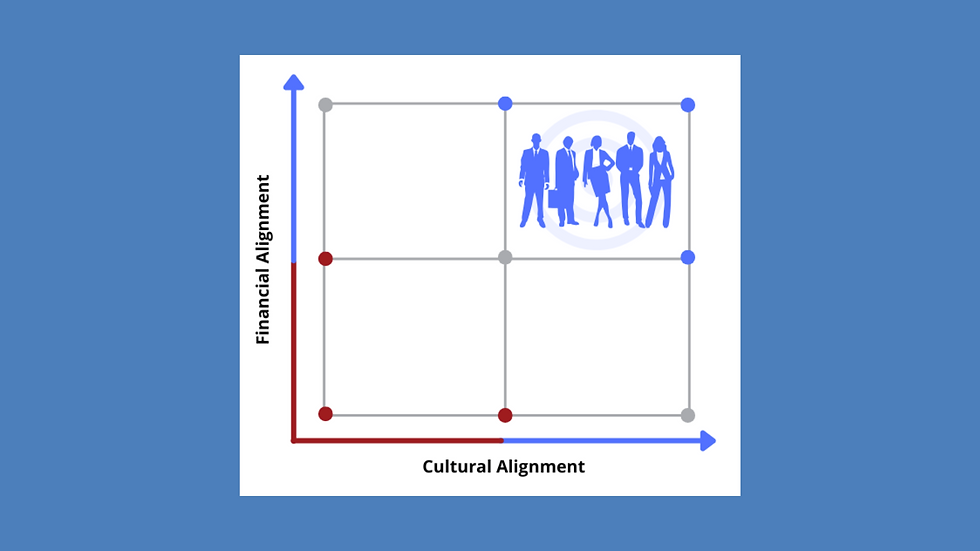

Financial Alignment

On the surface, Dirty Money clients seem like a blessing. They generate substantial revenue and are critical to your financial success. But when too much of your income relies on a single client (or a handful of clients), it creates dependency.

You don’t want to be held hostage by having too many eggs in one basket.

Cultural Misalignment

Dirty Money clients often have a negative impact on employee engagement and retention, and in some cases, they can even damage your reputation. These clients can become the wedge that drives right through the heart of your business.

As a Prospect

The key is to identify “Red Flags” early and take action.

If you haven’t yet, clearly defining both your Blue Chip client profile (ideal clients) and your Graveyard client profile (clients you want to avoid). Then, during the qualification stage of your sales process, assess your prospect’s alignment—not just financially but culturally.

I’m not suggesting you disqualify all Dirty Money prospects automatically. Instead, I recommend having open and honest conversations between your sales and delivery teams about the pros and cons of the prospect, reviewing concerns, and making a decision together. Always remain in control of whether to advance or disqualify. When both teams are aligned, you proceed with caution, and there’s no room for finger-pointing after the fact.

Too often, salespeople win bad business and then “throw it over the wall” for delivery to manage. That’s not sustainable.

As a Client

The truth is…Dirty Money clients are the ultimate test of your core values.

You can’t claim to care about your employees’ well-being if you allow clients to chew them up and spit them out. Unfortunately, too often, business owners feel trapped by bad business, and employee engagement suffers. High turnover often follows.

Whether these clients were misaligned from the beginning or became misaligned after a trigger event (like a key stakeholder turnover, change in ownership, or a won/lost project), you now find yourself managing a financially aligned but culturally misaligned client.

Thankfully, there are two key steps to take:

Account Management (Farming)

While not easy, I’ve seen Dirty Money clients successfully transformed into Blue Chip clients through Partnership Reviews. This involves providing candid feedback (both positive and constructive) and setting clearer expectations and rules of engagement. It requires confidence and a willingness to walk away if necessary—not all leaders are prepared for this. But when done correctly, it elevates the relationship from “vendor” to “partner.”

Most B2B service firms aspire to be seen as partners rather than vendors, and difficult conversations are key to elevating relationships. As Patrick Lencioni says, “All great relationships, the ones that last over time, require productive conflict in order to grow.”

Business Development (Hunting)

Winning more Blue Chip clients is critical for reducing dependency on Dirty Money clients. It’s much harder to stand your ground when you’re desperate. Don’t be a hostage. Proactively develop new business so you aren’t forced to rely on misaligned clients.

I vividly remember struggling as a salesperson early in my career. My boss’s advice was to “go get better business.” I thought he was being harsh, but in hindsight, he was right. As soon as I started winning better business, everything else fell into place, and I had much more confidence to have tough conversations with Dirty Money clients.

Conclusion

Dirty Money clients are incredibly risky. While financially rewarding, they can cause immense stress on your team and drive a wedge through your organization. Ultimately, how you manage these clients is a litmus test for your core values. Is it profits over people?

To thrive, you need to excel at assessing prospects early, enculturating misaligned clients (or being willing to part ways), and consistently building a pipeline of Blue Chip clients to grow your business on solid ground.

Nexts Steps

If you or your sales team are struggling to maximize time with your best prospects and clients, I invite you to join my cohort-based course called: "Beyond the Founder Rainmaker - Building Your Outbound Sales Strategy". You'll gain invaluable insights, practical tools, and actionable strategies to unlock the true potential of your business.

Go Deeper

Carver Peterson helps growth-minded leaders and organizations achieve predictable and sustainable revenue growth through a refined strategy, defined process and aligned structure.

Comments